A shortcut to view the full list of positions in your portfolio? Everything you need to make investment decisions is now presented in a new dashboard view. Perfect for the technical trader, this indicator captures an ETF’s technical events and converts them into short-, medium-, and long-term sentiment.

ProShares ETFs are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor. Quote data provided by Interactive Data – Real Time Services, Inc. and subject to terms of use. Registered Investment Companies are required by the IRS to distribute substantially all of their income and capital gains to shareholders at least annually. For specific tax advice, we recommend you speak with a qualified tax professional. BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings.

All data is from MSCI ESG Fund Ratings as of Mar 07, 2023, based on holdings as of Feb 28, 2023. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time. Visit the 360° Evaluator tool, exclusively for advisors, to analyze investments within a portfolio context in minutes. Learn how key attributes of this fund could factor into your decision-making. In general the ETF tends to have very controlled movements and with good liquidity the risk is considered very low in this stock. During the last day, the ETF moved $0.169 between high and low, or 1.14%.

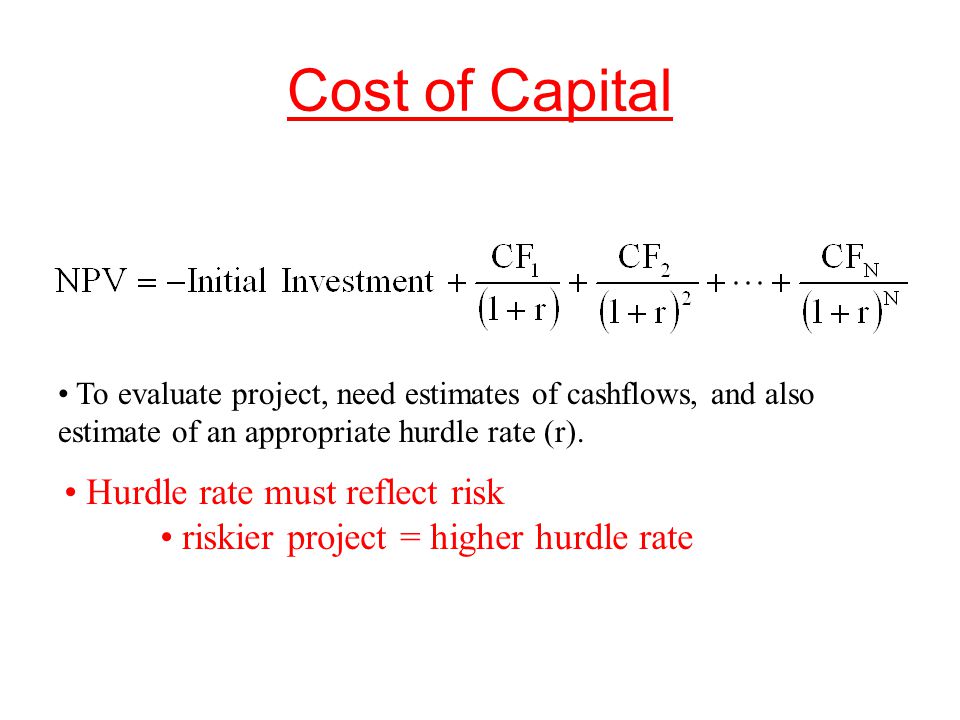

The key risk of inverse ETFs like SH lies in an understanding of the math of investment loss. When the market goes up and SH goes down consistently for a period of time, SH’s return is not as simple as the opposite of the S&P 500 when you look out over weeks or months. To us, that simply means one needs to know what they own when using this type of security. And, as with any traditional “long” investment, one needs to do their homework.

The ETF Trends and ETF Database brands have been trusted amongst advisors, institutional investors, and individual investors for a combined 25 years. The firms are uniquely positioned to aid advisor’s education, adoption, and usage of ETFs, as well as the asset management community’s transition from traditionally analog to digital interactions with the advisor community. This short ProShares ETF seeks a return that is -1x the return of its underlying benchmark for a single day, as measured from one NAV calculation to the next. Performance shown reflects fee waivers and/or expense reimbursements by the investment advisor to the fund for some or all of the periods shown. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be “0.00”.

Note that the ACF Yield will differ from the ETF’s Weighted Avg YTM.For more information on Aggregate Cash Flow Yield, see info here. The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. Currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. The calculated values may have been different if the valuation price were to have been used to calculate such values.

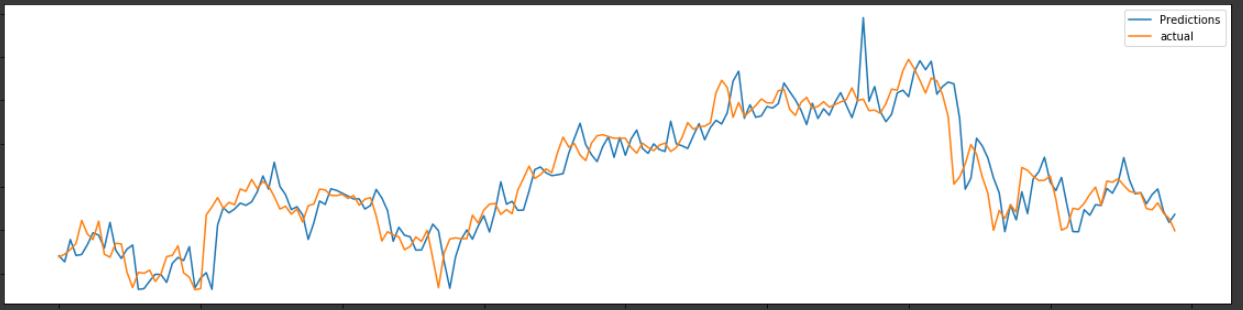

SH Performance

The company is the leader in strategies such as dividend growth, interest rate hedged bond and geared ETF investing. ProShares continues to innovate with products that provide strategic and tactical opportunities for investors to manage risk and enhance returns. Credit quality ratings on underlying securities of the fund are received from S&P, Moody’s and Fitch and converted to the equivalent S&P major rating category. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Below investment-grade is represented by a rating of BB and below. This should make SH and the array of other bear-market-fighting ETFs very popular with investors, if our forecast is even close to accurate.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. As the Federal Reserve begins to aggressively tighten its monetary policy and potentially trigger a recession in the process, wary investors could turn to alternative or bearish exchange traded fund s… Shares of any ETF are generally bought and sold at market price and are not individually redeemed from the fund. ProShares now offers one of the largest lineups of ETFs, with more than $60 billion in assets.

ProShares Short S&P500 seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P 500®. The Fund seeks daily investment results, before fees and expenses, that correspond to the inverse of the daily performance of the S&P 500 Index. For newly launched funds, Sustainability Characteristics are typically available 6 months after launch.

ProShares Short S&P500 ETF Forecast

A sell signal was issued from a pivot top point on Monday, March 13, 2023, and so far it has fallen -7.77%. Further fall is indicated until a new bottom pivot has been found. This may be an early warning and the ETF should be followed more closely. The great news is that the S&P’s loss is SH’s gain – literally. We see SH as one of many tools that exist to help investors not only defend bear markets, but attack them for potential profit. This ETF’s annual expense ratio of 0.89% might fool some investors.

- The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year.

- The following charts reflect the geographic spread of SH’s underlying holdings.

- The Fund seeks daily investment results, before fees and expenses, that correspond to the inverse of the daily performance of the S&P 500 Index.

Information is provided ‘as is’ and solely for informational purposes, not for https://1investing.in/ purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer. Here is a look at ETFs that currently offer attractive short selling opportunities. ETF Database’s Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund.

Markets

Certain sectors and markets perform exceptionally well based on current market conditions and iShares and BlackRock Funds can benefit from that performance. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

ProShares Short S&P 500 ETF: A Dangerous Way To Position For A … – Seeking Alpha

ProShares Short S&P 500 ETF: A Dangerous Way To Position For A ….

Posted: Fri, 21 May 2021 07:00:00 GMT [source]

The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above. For the first time in nearly 50 years, the world has a significant inflation problem. The Fed has to stamp out inflation, do it as forcefully as possible, and “break” the stock market temporarily if that’s what it takes.

Holdings

Any data, charts and other information provided on this page are intended to help self-directed investors evaluate exchange traded products , including, but limited to exchange traded funds and exchange traded notes . Criteria and inputs entered, including the choice to make ETP comparisons, are at the sole discretion of the user and are solely for the convenience of the user. Analyst opinions, ratings and reports are provided by third-parties unaffiliated with Fidelity. Fidelity does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating ETPs. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation and other individual factors and re-evaluate them on a periodic basis.

The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance data quoted. After a terrible April, the equity markets may still have more pain ahead. If an investor is still worried about further pullbacks, one might consider bearish or short exchange traded fund strategies …

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. ETF Database analysts have a combined 50 years in the ETF and Financial markets, covering every asset class and investment style. The team monitors new filings, new launches and new issuers to make sure we place each new ETF in the appropriate context so Financial Advisors can construct high quality portfolios. ETF Trends and ETF Database , the preeminent digital platforms for ETF news, research, tools, video, webcasts, native content channels, and more.

There is no guarantee any ProShares ETF will achieve its investment objective. If China succeeds at de-Americanizing the world, the right course of action for investors is to buy gold ETF, silver ETF, gold miner ETF, and junior gold miner ETF. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Share this fund with your financial planner to find out how it can fit in your portfolio. Results generated are for illustrative purposes only and are not representative of any specific investment outcome.

The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between equity index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto.

The Dow Jones Industrial Average fell nearly 550 points, dra… The bearish trend is likely to continue if the past 150 years of stock market history is any guide. The ETF industry is seeing explosive growth, piling up huge assets amid the stock market turmoil. This has resulted in enough liquidity in the ETF world, with most ETFs trading at extremely higher vol… Index information does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains.

SH aims to accomplish its “inverse” objective by first investing its cash in U.S. That provides the collateral to execute what simulates a “short” position in the S&P 500 index. Since you can’t invest directly in an index, the fund uses an array of derivative instruments. Top basket holdings are as of the date indicated and may not be representative of the funds current or future investments. While U.S. equities enjoyed a strong rebound on Tuesday, short or bearish interest remains and financial strategists warned that more declines are likely with investors too complacent about the possib… Having a sound investment strategy can help smooth out the turbulence in your portfolio and save you from getting caught up in a herd mentality of selling low into a down market.

Before netflix loses sixteen billion in market value in any exchange traded product, you should consider its investment objective, risks, charges and expenses. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. The adjacent table gives investors an individual Realtime Rating for SH on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating. The “A+ Metric Rated ETF” field, available to ETF Database Pro members, shows the ETF in the Inverse Equities with the highest Metric Realtime Rating for each individual field.

Given that SH is essentially the S&P 500 in reverse, the more overvalued we believe the S&P 500 is the more undervalued we’d expect to view SH. Below is a chart of S&P 500 earnings over the past few decades – the grey-shaded areas show recessions. You can see that S&P 500 earnings drop sharply leading into and during recessions. We think that’s the most likely scenario for the next two to three quarters, at least.

What is wrong with inverse ETFs? – ETF Stream

What is wrong with inverse ETFs?.

Posted: Wed, 31 Aug 2022 07:00:00 GMT [source]

Please note you can display only one indicator at a time in this view. Please use Advanced Chart if you want to display more than one. Use Notebook to save your investment ideas in one convenient, private, and secure place. Get to know an ETF’s objectives, holdings, and performance all in a quick summary. See the top analysts’ ratings for an ETF, and get one-click access to their research reports.

IShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience and a global line-up of 1,250+ ETFs, iShares continues to drive progress for the financial industry. IShares funds are powered by the expert portfolio and risk management of BlackRock. In fact, its derivatives exposure might result in it being “short” the S&P 500’s dividend, which could slightly drag on its return vs. the inverse S&P 500. Countering this is the recent surge in yields on T-bills, which might allow SH to accrue more interest on that collateral. Either way, income and yield are not priority factors in considering an investment in SH.